Photo by Rafa Elias/Moment via Getty Images

ON Semiconductor Corporation or onsemi (NASDAQ:ON) investors who decided to buy in November after its third-quarter earnings plunge have done well, outperforming the S&P 500 (SPX) (SPY) since my previous update. I highlighted the capitulation of ON in my November articlearguing why ON’s valuation has normalized from its 2023 highs. As a result, it looked much more attractive, leading me to add exposure, given the fantastic dip-buying opportunity. As a result, I upgraded ON, assessing a solid setup for new and current investors to pick their spots.

Despite that, the initial recovery in ON topped out in mid-December 2023, as the ongoing weakness in the EV and renewable energy markets likely didn’t inspire confidence in ON dip-buyers to hold on to their positions. Despite that, I assessed onsemi management and provided a reasonable fourth-quarter earnings commentary. However, onsemi’s forward guidance suggests 2024 will likely be another year of growth normalization, as its topline growth reached its cycle peak in 2022.

Investors should recall that onsemi achieved Q4 revenue growth of -1% in 2023, in line with the broad weakness in its automotive and industrial market segments. These two segments accounted for 80% of its FY23 revenue base, as onsemi pivots toward capitalizing on the “high-growth megatrends for sustainable ecosystem development.” However, while the long-term secular growth themes remain intact, near-term cyclical challenges emerged in late 2023, particularly in the EV industry. Given onsemi’s increasing exposure, it should be clear why investors must be circumspect about their previous bullish thesis, as ON surged toward its unsustainable July 2023 highs.

Investors were also likely caught off-guard by the marked shift in sentiments, as even the EV players were surprised by the recent weakness. Even the leading clean energy leaders took a significant tumble, highlighting the need to remind ourselves to respect market cycles.

onsemi’s first-quarter outlook also came in below the previous analysts’ estimates. Accordingly, the company guided to a midpoint revenue estimate of $1.85B, reflecting “continued softness across all end markets.” Close followers of onsemi should be aware of the company’s market share gains in silicon carbide or SiC. Accordingly, onsemi updated us that it has attained a 25% market share. Management believes it could “grow at 2x the market growth in 2024, leveraging customer ramp-ups in industrial and automotive sectors.”

Moreover, management’s commentary indicates that its utilization could bottom out in the first half. onsemi highlighted its confidence in maintaining a “gross margin above the mid-40% floor with utilization in the mid-60% range.” With its utilization dropping to 66%, it’s reasonable to assume that we should have observed its medium-term bottom. The company indicated a midpoint gross margin outlook of 45.5% in Q1, down from Q4’s 46.7% metric. Revised analysts’ estimates suggest that the company could finish 2024 with a gross margin of 45.7%. onsemi indicated that it remains focused on execution in 2024, paying attention to improving its profitability profile as it digests the ongoing growth normalization. Accordingly, it anticipates the actions taken to focus on higher-valued market segments as constructive to emerging from the downturn in a better shape.

I assessed that the near-term demand/supply dynamics in the auto chips market could remain uncertain. That should explain why ON fell toward its November 2023 lows, down nearly 45% from its July 2023 highs. However, even the lowered Q1’24 guidance didn’t lead to a further selloff, suggesting that ON likely struck peak pessimism late last year. As a result, the market is likely looking ahead, as onsemi remains well-positioned to lead its potential cyclical upswing. Investors who decide to wait until the coast is clear could continue missing out on its ongoing recovery.

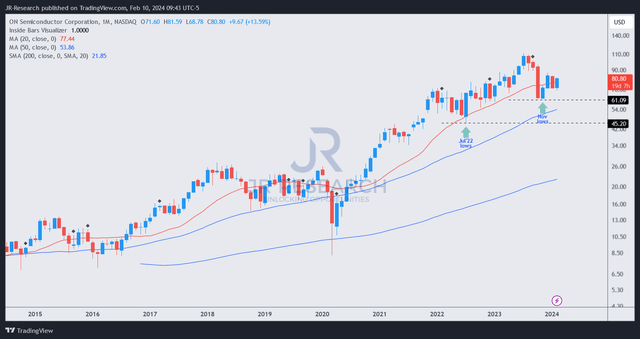

ON price chart (monthly, long-term) (TradingView)

ON’s price action clearly indicates its long-term uptrend bias. Dip buyers robustly defended ON’s November 2023 lows at the $61 level. While the January selloff digested its December gains, the post-Q4 earnings recovery suggests that the market wasn’t unduly concerned with the tepid Q1’24 guidance.

As a result, investors are given another opportunity to buy into ON’s long-term growth thesis before it continues on its uptrend bias toward its 2023 highs. Don’t wait until all the good news arrives before you make your move. By then, you could end up chasing the next potential cycle peak.

Rating: Maintain Buy.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!