Richard Drury

Thesis

The SPDR Bloomberg Investment Grade Floating Rate ETF (NYSEARCA:FLRN) is a name we last covered in last year. The fund is a low duration instrument that targets investment grade floating rate instruments, and we liked the name and structure when we reviewed it. We assigned the ETF a ‘Buy’ rating at the time, and indeed the name has performed:

Prior Rating (Seeking Alpha)

Not only is the fund up 5% since our rating, but it has done so with a sub 1% volatility profile. We argued in our first article, the ETF was a good choice in a high rate environment, with the spread pick-up over treasuries attractive in a benign default macrocycle.

With the September 2024 Fed cut a done deal at this point, we are going to revisit the name, and highlight why we are downgrading FLRN to ‘Hold’, believing that at the start of a Fed cutting cycle low-risk fixed-rate funds are now more attractive.

The Fed is set to cut – the question is how much, rather than ‘if’

The market is expecting a Fed cut in September 2024, with Fed Funds futures pricing 100% certainty around the event. The question that most market participants are asking is around the size of cuts and velocity:

Fed Cuts (Investment Week)

We are of the opinion that the Fed will cut by 25 bps only, and start a progressive cutting cycle that will see 25 bps reductions at every meeting going forward until the end of 2025. Indeed, the Fed is data-dependent, but no economic release suggests an Armageddon scenario. While the labor market is weakening, it is not falling off a cliff, and while inflation is moving lower, it is still above the 2% Fed target. These balancing elements point squarely towards a string of 25 bps cuts, with a sudden deterioration in the labor market potentially increasing the chances for a 50 bps cut.

We are in the same camp as PIMCO, which argued in a nice piece posted on the Seeking Alpha platform that they see three rate cuts of 25 bps in 2024.

FLRN composition – floating rate assets

FLRN is composed of investment grade floating rate assets that have a low duration and maximum maturity of up to 5 years. The name is overweight better rated IG paper:

AAA names 31% of the fund AA names 21% of the fund A names 42% of the fund BBB names 6% of the fund

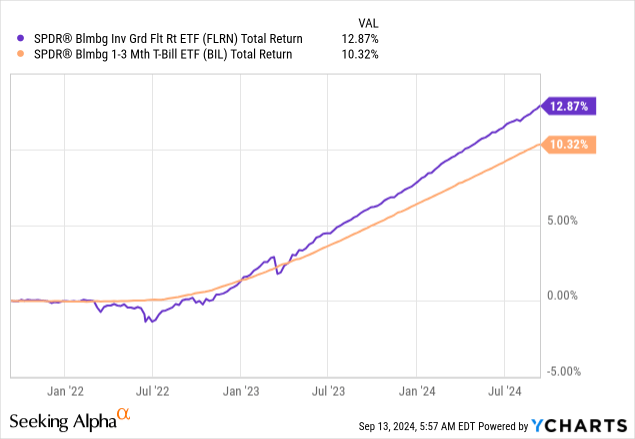

Via this composition, the fund reduces its exposure to credit spreads, thus explaining the very low historic volatility associated with the fund. While the name has a low credit default risk, its total return is mainly driven by short-end rates. With Fed Funds and SOFR high, the name has delivered in the past years very attractive returns:

The ETF has been able to offer a steady, upward sloping total return that beat simple treasuries. Just like short-dated bills funds, FLRN will see a one-for-one reduction in yield as the Fed cuts rates. There will be a lag given the SOFR re-set profile and calculation, but the cuts will have a direct impact to the dividend the fund disburses.

While its low duration has been an asset during the Fed tightening cycle, the fund will experience the opposite as rates move lower.

Fixed rate over floating rate

As the Fed cutting cycle is finally set to start, retail investors should favor quality short maturity fixed rate assets over floating rate ones. A low maturity and duration profile ensures a low exposure to the volatility stemming from interest rate fluctuations, but at the same time offers an attractive dividend. We have reviewed a number of names in the past that fit that profile:

NEAR: Revisiting This BlackRock Fund After The Mandate Change (Rating Upgrade) SHY: Smart Duration Play, 4.9% Yield

Both funds have a duration close to 1.6 years, and they represent investment grade or treasury portfolios which contain only fixed rate assets. This, however, does not mean FLRN will not deliver. Quite the opposite. The fund will continue to produce a total return driven by its dividend yield, but that return will be ever decreasing. The fund has a 5.9% current yield, and we expect that figure to decrease by 0.75% as the Fed cuts by 75 bps in our base case by the end of 2024.

The overall macro picture of switching from floating to fixed will be further compounded by investor flows. We have seen this already happen in the high-yield space, where capital is being reallocated from floating rate leveraged loans to fixed rate bonds. Expect this flow to percolate across all asset classes.

Conclusion

FLRN is a fixed income exchange-traded fund. The vehicle focuses on low duration floating rate investment grade bonds. The ETF has been able to post very attractive returns in the past three years as rates moved higher and fixed rate instruments lost value. In essence, FLRN has been a pass-through for higher rates with a credit spread on top. The opposite will occur now that the Fed is set to start cutting rates in September 2024. FLRN will see its dividend move lower one to one as the Fed cuts, with fixed rate investment grade names set to benefit. While the fund is still an attractive proposal to hold given its low credit risk, it no longer presents an attractive entry point given the macrocycle. We are therefore downgrading the fund from ‘Buy’ to ‘Hold’.