honglouwawa

Every three months, we take a snapshot of the expectations for future earnings in the S&P 500 (SPX) at approximately the midpoint of the current quarter, shortly after most U.S. firms have announced their previous quarter’s earnings.

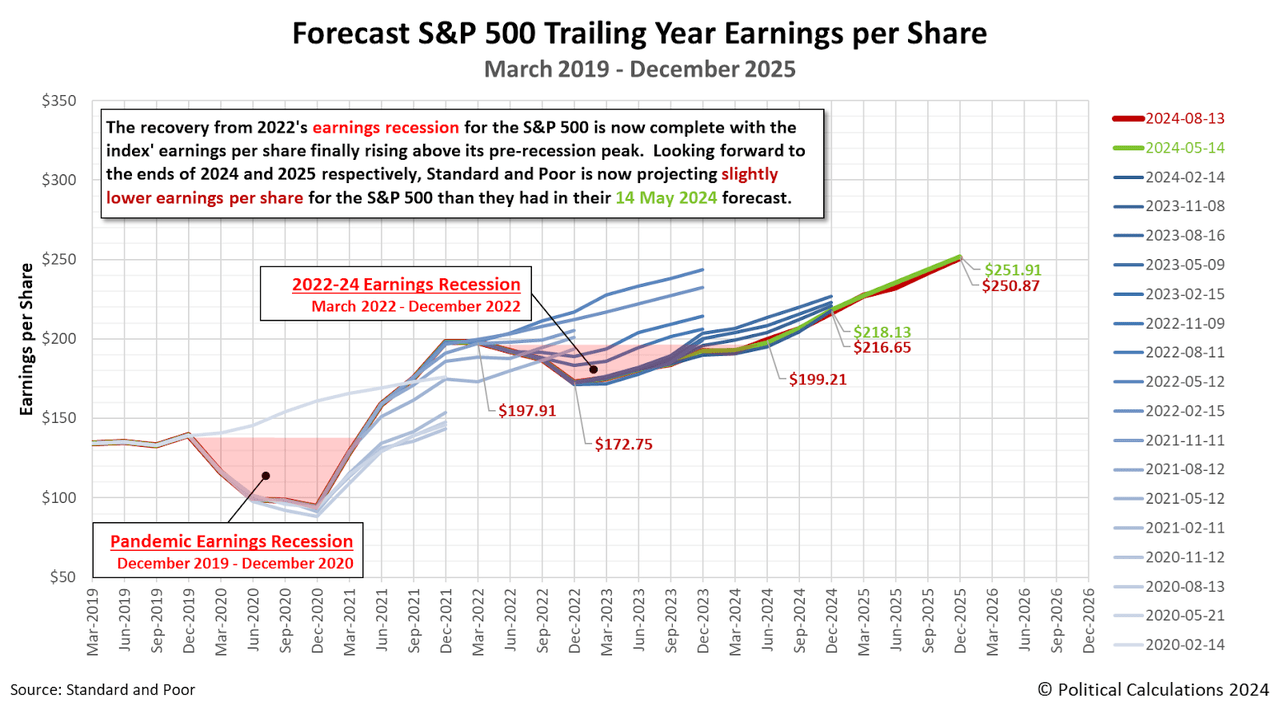

The recovery from 2022’s earnings recession for the S&P 500 is now complete, with the index’s earnings per share in June 2024 finally rising above its pre-recession peak recorded back in March 2022. Earnings per share in the S&P 500 had fallen by 12.7% from March 2022 to December 2022 before their slow and uneven recovery over the following eighteen months.

By contrast, the recovery from 2020s Coronavirus Pandemic Recession was much quicker, with the index taking less than two quarters to fully regain the earnings per share it lost after the government-mandated lockdowns that shuttered economic activity were lifted.

Looking forward to the ends of 2024 and 2025 respectively, Standard & Poor’s is now projecting slightly lower earnings per share for the S&P 500 than they had in their 14 May 2024 forecast. S&P’s projected earnings per share for December 2024 is $216.65 per share, while December 2025’s earnings per share are now anticipated to come in at $250.87 per share.

All these developments are shown on the following chart:

If we include the near-zero rate of earnings per share growth the S&P 500 saw from December 2021 to March 2022, the S&P 500’s earnings recession fully overlaps the two quarters of negative real GDP growth the U.S. economy went through in the first half of 2022 as inflation raged out of control. As it was, the earnings of the companies that make up the S&P 500 index had enough positive momentum coming out of 2021 to record a positive gain in the first quarter of 2022 of just four cents per share over the previous quarter’s level, which is why it narrowly avoids being included in the earnings recession.

Reference

Silverblatt, Howard. Standard & Poor’s. S&P 500 Earnings and Estimates. [Excel Spreadsheet]. 13 August 2024. Accessed 17 August 2024.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.