shulz

One of the cheaper semis

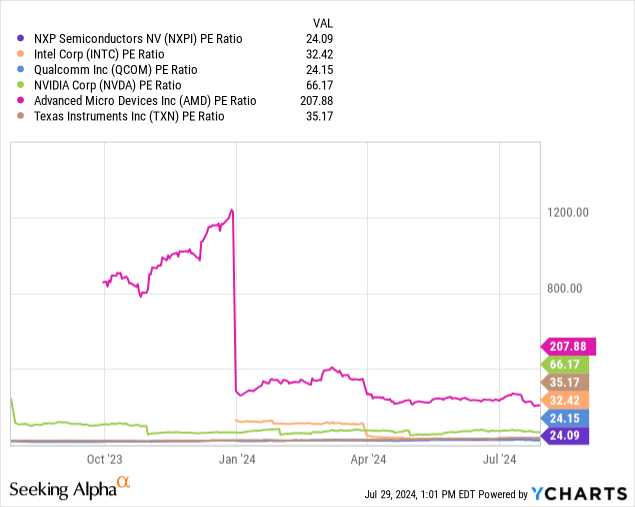

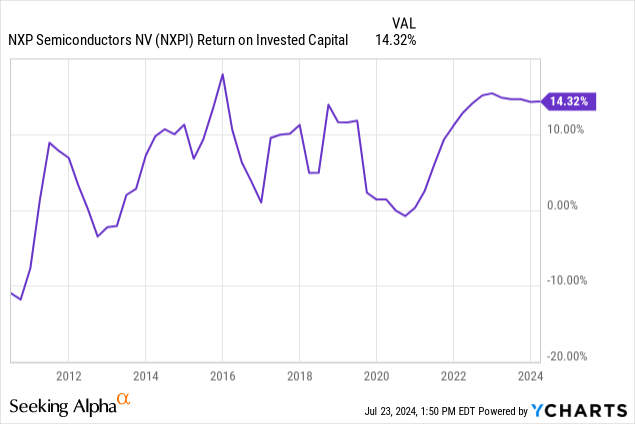

On a P/E ratio basis, NXP semiconductors (NASDAQ: NXPI), is one of the cheaper semis. This is not saying a whole lot as this cyclical segment of the economy is trading near the top of their cyclical return on invested capital cycles which have expanded multiples.

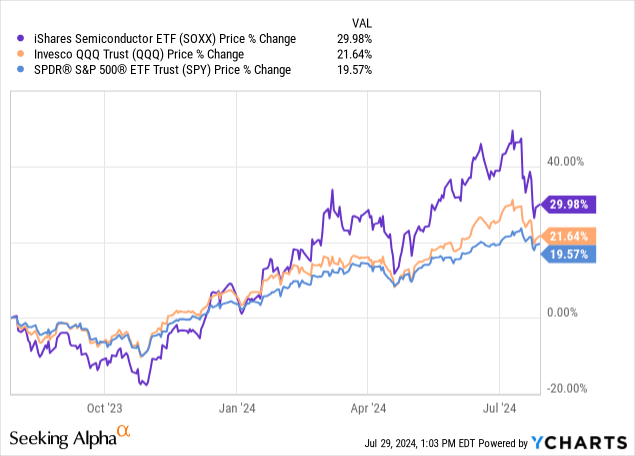

With the sector itself outperforming both the Nasdaq (QQQ) and the S&P 500 (SPY), we have to ask ourselves if this prolonged up cycle will continue for the next few years to make further capital allocation worthwhile. My largest semiconductor holding is Qualcomm(QCOM), a close comp to NXP in what they do with the mix of automotive, IoT, and cellular chips. We can also see that both trade at around 24 X earnings which is now considered the “cheap” end for semis.

I would exercise caution when any multiples approach and exceed 25 X earnings as this would also imply a 25% or more expected growth rate in earnings when using the PEG ratio. Peter Lynch recommended staying away from hot industries that trade at multiples exceeding 25.

What they do and revenue distribution

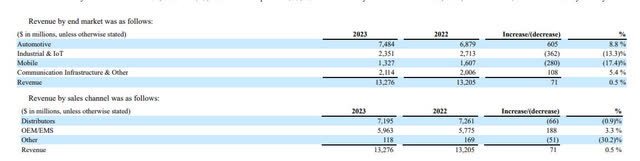

From the most recent 10K:

NXP Semiconductors N.V. is a global semiconductor company and a long-standing supplier in the industry, with over 70 years of innovation and operating history.

We provide leading solutions that leverage our combined portfolio of intellectual property, deep application knowledge, process technology and manufacturing expertise in the domains of cryptography-security, high-speed interface, radio frequency (RF), mixed-signal analog-digital (mixed A/D), power management, digital signal processing and embedded system design. Our product solutions are used in a wide range of end market applications including: automotive, industrial & Internet of Things (IoT), mobile, and communication infrastructure. We engage with leading global original equipment manufacturers (OEMs) and sell products in all major geographic regions.

Revenue distribution

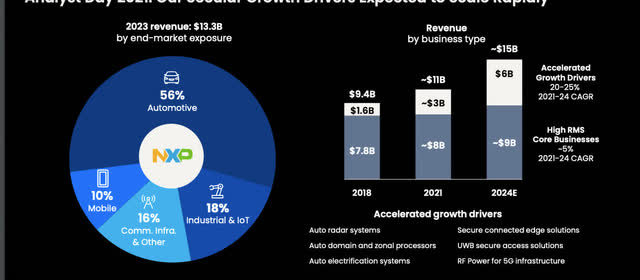

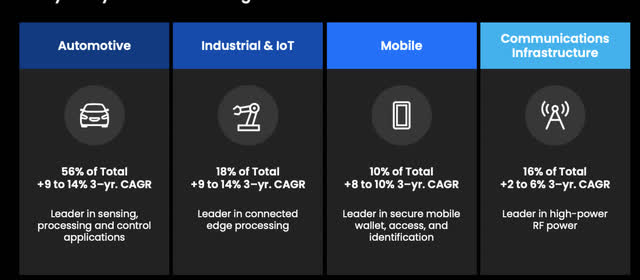

NXP 2024 Q2 Presentation

Data based on most recent 10K:

NXP MRFY 10K

Automotive 56.30% Industrial & IoT 17.70% Mobile 10.00% Communication and Infrastructure 15.90% Click to enlarge

Although P/E ratio and chip segment-wise NXP comps very closely to Qualcomm, the revenue mix is different. In Qualcomm’s case, mobile would be nearly flipped with what NXP rakes in on the automotive line and vice versa.I want to emphasize that a bet on NXP at these levels is a bet on a healthy automotive industry.

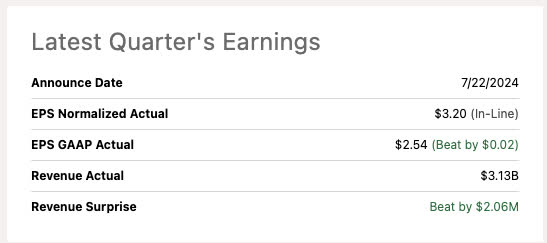

Latest earnings and call

Seeking Alpha

Two beats but weak guidance have sent NXP down since the print:

Comments from the most recent earnings call:

CEO Kurt Sivers:

Now let me turn to the specific trends in our focus end markets. In automotive, revenue was $1.73 billion, down 7% versus the year-ago period and in line with our guidance. We have worked with our direct Tier 1 customers to ensure a continued orderly process of inventory digestion.

In industrial and IoT, revenue was $616 million, up 7% versus the year-ago period and in line with our guidance. Our performance compared favorably versus the year-ago period, driven by demand in China and Asia Pacific, while the trends in the European and North American markets remained soft. In mobile, revenue was $345 million, up 21% versus the year-ago period and in line with our guidance. And finally, in communication infrastructure and other, revenue was $438 million, down 23% year-on-year and in line with our guidance.

Here we can see revenue guidance for automotive hit their midpoint, which was still down -7% year over year. The language of working with the direct Tier 1 customers to ensure inventory digestion sounds like another way of asking their end users to make more cars. With over 56% of revenue concentrated on what might be a sector with negative year-over-year demand, this could set the scene for a value trap. Again, this is not value from a pure EPS multiple perspective, but from an expected growth perspective. With this in mind, growth over earnings is the focus in my opinion.

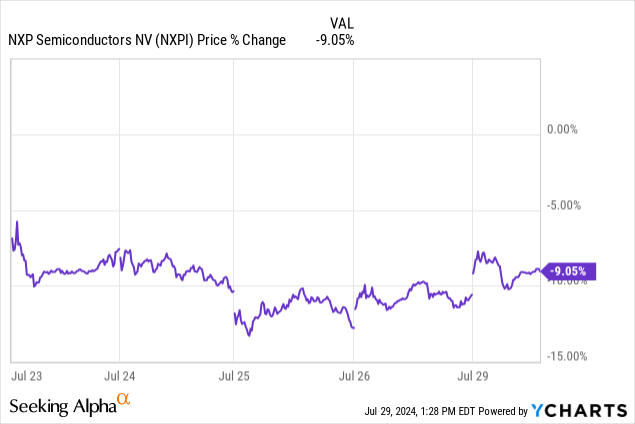

Regional sales

2024 Q2 NXPI presentation

The 33% China number is another issue not just for NXP but for other semis with market share in China as well. Trade restrictions for semis sold to China might only intensify should we see a second Trump presidency.On top of this, the third plenary session of the CCP just convenedandthere were few economic stimulus measures suggested.The worst of all is that China wants to implement a provincial sales tax which never existed before.This is in response to the lack of demand for land purchase by real estate developers which was the previous primary source of tax revenue for the CCP.

With sales tax sticker shock bound to happen in China after implementation on large ticket items, it doesn’t bode well for increasing auto sales in China.

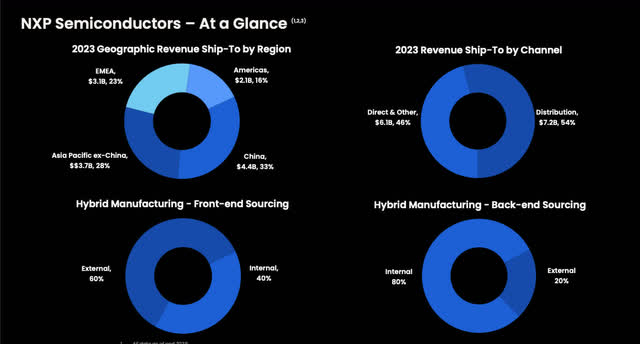

Price vs EPS growth trends

Since 2021, NXP has entered a bullish pattern in earnings per share trending well above the 10-year share price growth rate. The revenue has lagged the price growth, but the gross profit margins which average around 50% per annum for this stretch, have more than made up for the lag in volume.

Return on invested capital

All data in millions courtesy of Seeking Alpha

Let’s take a look at the two using the following:

NOPAT (net operating income after taxes)/total LT + ST borrowings + total equity, aka “invested capital”.

NOPAT = TTM EBIT of 3,766 X (1-16.1%)= $3,159 Short term debt= 1,304 Long term debt =10,178 Total equity capital= 8,829 Total invested capital= 20,311 NOPAT ($3,159)/Invested capital (20,311)= 15.5 % ROIC

The return on invested capital for my TTM calculations and the data provided by YCharts are pretty close. The firm’s returns oscillate in a pretty cyclical fashion spiking up and down every 2 years or so with the upper limit about where we are at right now near 15%.

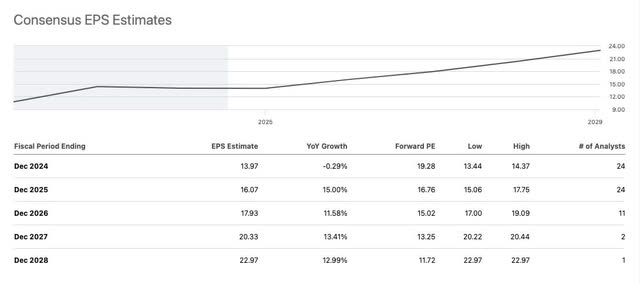

Charlie Munger once said that you’ll get about the return in the long run that the firm gets on its invested capital. As we’ll see in the below valuation paragraphs, the most bullish estimates are a 27% growth rate in earnings between 2024 and 2025, the bearish end would be a 7.08% growth rate which would mean NXP could be expected to enter a down cycle at that time.

The average of the two would be somewhere around a 17% growth rate which would put the company in a faster earnings growth cycle than their return on invested capital.

Forward EPS Estimates

Seeking Alpha

Valuation based on PEG ratios using 2025 numbers

High end estimates of $17.75/share- 27% growth over 2024 FY estimates

Using 27 [ the year over year growth rate form FY 2024 to high end 2025] as the multiple and 2025 EPS of $17.75 as the multiplicand, we would get a fair price at PEG 1 at 27 X $17.75= $479

Low end estimates at $15.06/share- 7.08% growth over 2024 FY estimates

Using 7.08 [ the year over year growth rate form FY 2024 to high end 2025] as the multiple and 2025 EPS of $15.06 as the multiplicand, we would get a fair price at PEG 1 at 7.08 X $15.06= $106.62/share

Average of the two models blended price target: $292.93

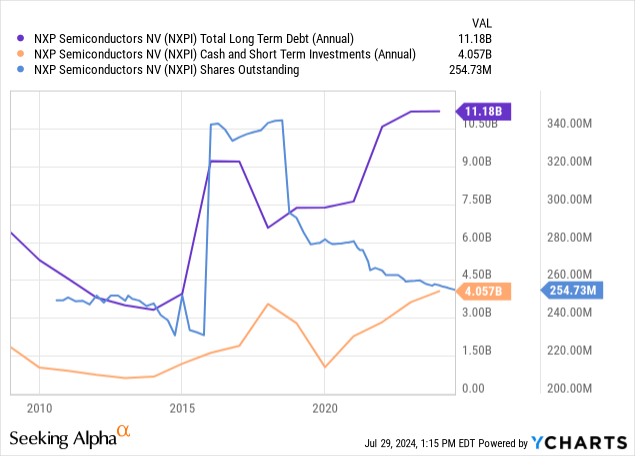

Balance sheet

Long-term debt is about 3 X cash and equivalents. This is a decent balance sheet but not the best in the sector. Shares outstanding have fallen generously since 2019, but are still above previous levels. I would consider this an improving balance sheet after going through a rough patch from 2015 to 2020 where share dilution occurred, debt spiked and cash dipped.

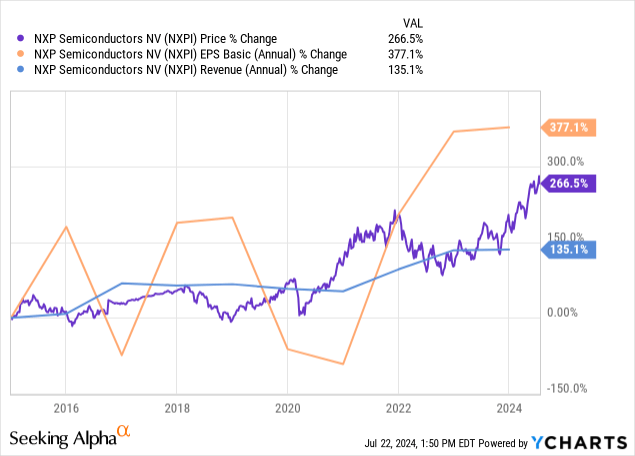

My opinion and risks

NXP 2024 Q2 Presentation

Here we can see that the highest growth rate driver that NXP has been using to drive multiples and share price is automotive at a 9-14% 3-year CAGR.

Typically I would like to see a 20% discount to intrinsic value, or in this case around $233 before a purchase. One of the larger issues is that NXP gets 56% of revenues from the automotive industry and most car manufacturers are reporting flattening sales. Looking at the ROIC chart, we see a prolonged upswing in returns on capital which is elongated over previous cycles. I would be cautious in believing that this cycle will last through the end of 2025 to drive the price up above the target.

Again with automotive being the biggest contributor to the long up cycle for NXP, an investor has to ask themselves if that growth rate is sustainable through 2025 to hit high-end analyst projections. Industrial and IoT has a similarly large growth rate but needs to increase even more rapidly in my opinion to make up for any down trends in the automotive segment.

In my opinion, I would rather continue to bet on Qualcomm versus NXP as handsets make up a large proportion of their revenue mix which seems more sustainable for a long up cycle than automotive. Both are trading at similar multiples, conduct healthy buybacks and Qualcomm pays a slightly higher dividend.

Summary

In my opinion, the stock is a hold. Although it is trading at a discount to blended intrinsic value, this is taking into consideration that the growth rate targets for 2025 will be accurate. Observing the underlying return on capital trends leads me to believe I need a bigger discount before wading in, somewhere in the $230s. Being so heavily reliant on automotive semi conductors is a negative in my opinion being that the core client may be entering a down cycle themselves. Hold.