Onurdongel

Roku’s (NASDAQ:YEAR) growth rate has recovered in recent quarters, although this has been driven in large part by relatively easy comparable periods. Growth will moderate in coming quarters, which is problematic given the enormous amount of money currently being poured into sales and marketing.

I previously suggested that despite relatively poor efficiency, Roku’s stock would likely move higher longer term, driven by growth and the company’s current low valuation. Roku’s share price is around 7% higher since then, albeit with significantly volatility. While I still believe Roku’s share price should be higher, the company’s inability to reduce operating expenses or drive growth higher have tempered my opinion.

Market Conditions

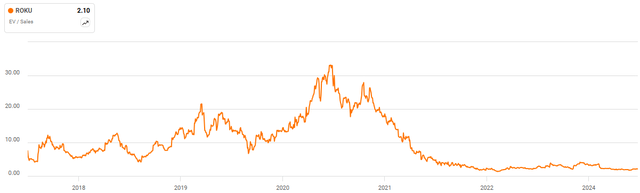

While Roku’s business has picked up in recent quarters, consumer spending remains under pressure and the market is likely still adjusting to demand pulled forward during the pandemic. This continues to impact Roku’s device revenue and its ability to expand its user base.

Figure 1: Roku and Vizio Device Revenue (source: Created by author using data from company reports)

Video advertising on Roku’s platform outperformed the overall ad market and the linear TV ad market in the US in the first quarter. Consumer packaged goods, retail and autos were areas of strength, while the insurance vertical remained challenged. While ad demand appears reasonable at the moment, the market is suffering from the increase in inventory being driven by companies like Amazon (AMZN) and Netflix (NFLX).

Roku Business Updates

Over the past year, Roku has shifted priority from cost-cutting to growth. The company is focused on three opportunities:

Maximizing the value of the Roku home screen Growing Roku billed subscriptions Growing ad demand

While this will improve monetization, the lack of focus on international expansion is a concern. Roku is likely fairly saturated in the US and without much greater international success, the company’s long-term prospects will be severely hampered.

Roku recently added a video ad unit to the home screen and has developed a virtual “showroom” that enables users to explore products after clicking on an ad. Roku can also help companies build new experiences that are entertaining and engage viewers, helping them to decide which app to run. The home screen is strategically valuable real estate which is currently under monetized. While the home screen is potentially valuable, and innovation could help the company to realize this value, Roku’s problems are more related to demand at this point in time.

Roku Pay is a payment and billing service which reduces friction in the sign-up service. It seems like a relatively low share of subscriptions on the platform are currently billed through Roku Pay. This could provide Roku with a large growth opportunity long-term, but this is dependent on Roku being the dominant TV operating system.

Roku has switched focus to third-party partners to help drive ad demand. This includes retail media networks, DSPs and other strategic partners. Roku is also adding to its in-house programmatic capabilities, with programmatic ad spend continuing to grow as a percentage of total video ad spend on the platform.

The Roku Channel was the number 3 app on the platform in Q1, with engagement up 66% YoY. There is a large opportunity to close the gap between engagement and fill rates, though, an area where programmatic ad capabilities can help.

Roku’s international expansion efforts continue to progress, but I feel like the company has largely missed the international opportunity given how slowly it is moving. The Roku Channel has been launched in Mexico and 40% of TVs sold there are now Roku TVs. Roku is starting to monetize in Mexico and continues to monetize in Canada, the UK and Germany. We are starting to monetize in areas like Mexico and continue to monetize in areas like Canada, UK, and Germany.

Roku recently expanded its TV lineup by introducing the Roku Pro Series, which is targeted at the high-end of the market. The Pro Series offers advanced features, like a 4K QLED display and enhanced audio technology. Roku also has its range of smart home devices (cameras, video doorbells, smart light bulbs, etc.). These are white labeled products that are priced for mass adoption and hence are likely to be a loss leader. Despite the launch of Roku-branded TVs and smart home devices, Roku’s device sales remain relatively soft. I view this business as a loss-leader designed to help the company acquire platform users, so this only really matters to the extent that it impacts account growth.

Financial Analysis

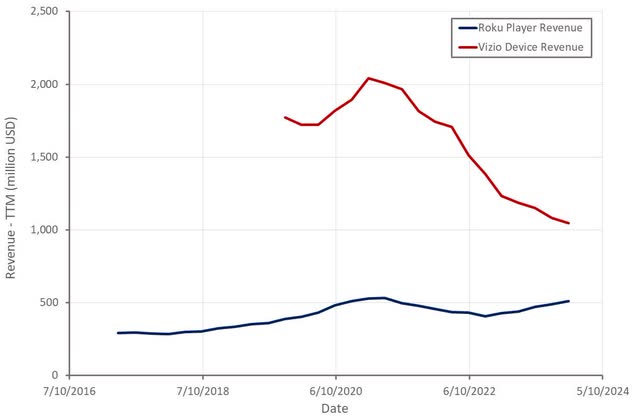

Roku’s revenue increased 19% YoY in the first quarter to $755 million, driven by streaming service distribution, advertising activities and Roku branded TVs. Streaming households increased 14% YoY in Q1, while streaming hours were up 23% and platform revenue grew 19%. Device revenue also increased 19% YoY, although relatively weak device growth on the back of a more favorable demand environment and the launch of premium TVs and smart home devices is a concern.

Roku expects to generate $935 million revenue in the second quarter, representing approximately 10% YoY growth. Roku will lap subscription price increases in 2024, making comparables more difficult as the year progresses.

Figure 2: Roku Revenue (source: Created by author using data from Roku)

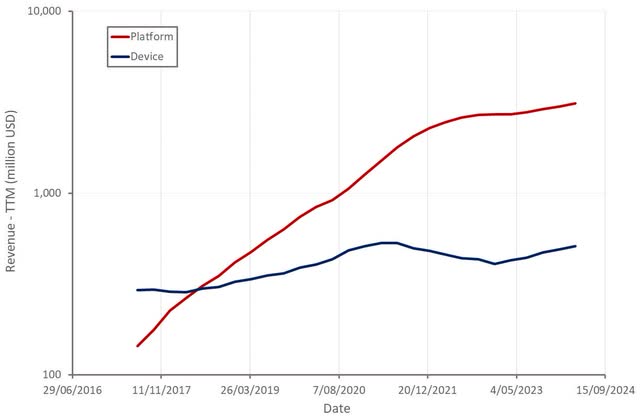

Roku’s user base continues to grow at a reasonable health. What is concerning is that Roku has dramatically increased its sales and marketing spend in recent years and yet account growth has been fairly constant in absolute terms. This indicates higher customer acquisition costs, calling into question the success of the company’s international expansion and long-term profitability.

ARPU has been fairly constant over the past few years, which Roku has attributed to growth in international markets where monetization is low. Flat / declining ARPU and modest account growth isn’t a recipe for strong platform growth, though.

Figure 3: Roku Active Accounts (source: Created by author using data from Roku)

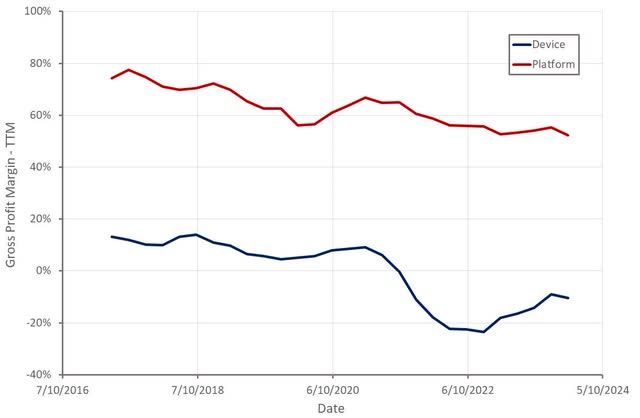

Roku’s gross margins remain under pressure. Platform margins are being pressured by revenue mix and international growth. Excluding a one-time licensing catch-up benefit recorded in Q1 2023, device gross margins were roughly flat YoY.

Figure 4: Roku Gross Profit Margins (source: Created by author using data from Roku)

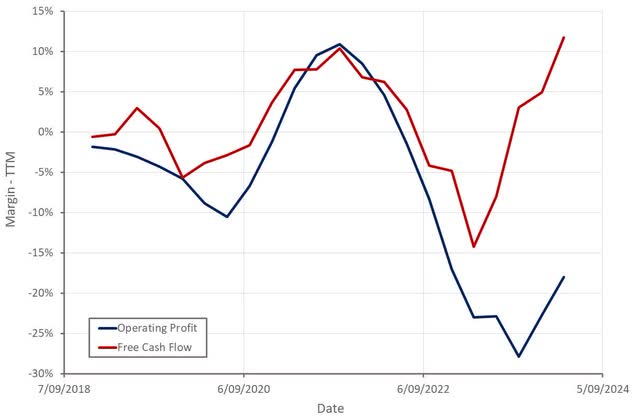

Roku’s operating profitability continues to improve on the back of operating leverage and cost-cutting efforts. Free cash flows look healthier, with the difference largely due to stock-based compensation and content amortization. Given current levels of sales and marketing spend, it is not clear that Roku can generate decent profit margins and continue to grow its user base.

Figure 5: Roku Free Cash Flow (source: Created by author using data from Roku)

Conclusion

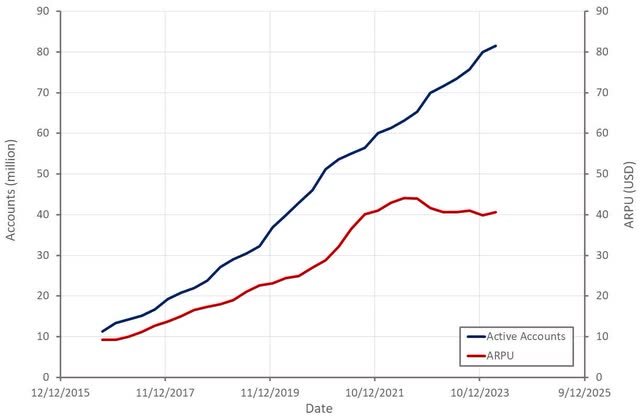

Roku’s revenue multiple continues to hover near all-time lows, but this is largely the result of the company’s modest growth and poor margins. Until Roku can sustainably accelerate its growth rate or significantly reduce its sales and marketing spend, I don’t expect much multiple expansion. Competition also remains an issue, particularly internationally, where Roku is a relatively late mover.

Figure 6: Roku EV/S Ratio (source: Seeking Alpha)