Solskin/DigitalVision via Getty Images

Biotechnology is the source of many scientific and technical breakthroughs, making meaningful contributions to industries such as healthcare, energy, and agriculture. The sector is witnessing exponential growth, driven by the acceptance of emerging technologies and services that address significant global challenges. Modern biotech has a broad landscape of innovations, such as engineered lifesaving therapeutics, advanced medical systems and devices, and biological enzymes that dissolve plastic waste.

The VanEck Biotech ETF (NASDAQ:BBH) is an exchange-traded fund that aims to track the performance of the MVIS US Listed Biotech 25 Index. This index includes 25 of the largest and most liquid U.S.-listed biotechnology companies. The ETF provides investors with exposure to a concentrated portfolio of leading biotech firms, which are fundamentally involved in the research, development, and commercialization of innovative therapies, treatments, and technologies in the healthcare sector.

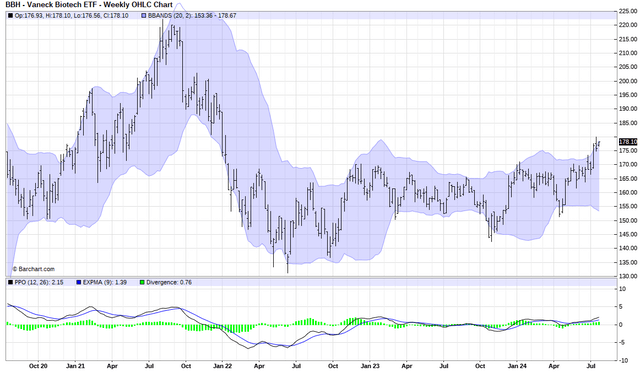

But I need a good-looking chart to buy something, or at least place a buy rating on it for the purposes of my work on Seeking Alpha. Fortunately, with BBH that is the case.

BBH’s long-term chart looks attractive

That looks like an intermediate-term breakout to me. After 5 years filled with excitement aka volatility that led to a flat price over the period, finally, it appears BBH is breaking out. Undoubtedly, there will be pullbacks, whether earnings-related or otherwise. But this is an encouraging sign, as is the monthly chart (not shown). The PPO indicator in the lower part of the chart also looks at least mildly encouraging, as it is trying to break above the zero line that indicates positive momentum.

Barchart

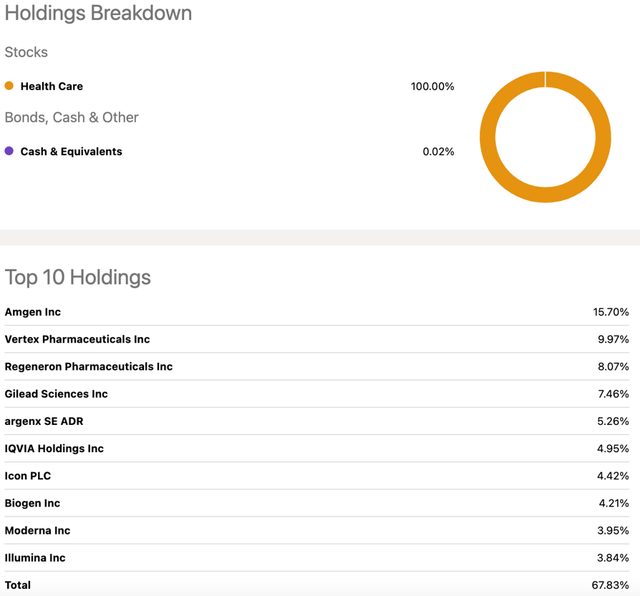

BBH’s holdings are my kind of setup for an ETF. Most in my field want so much diversification in their ETFs, they diversify away a lot of potential alpha. To me, ETFs are simply expanded stock baskets beyond the risk of a single stock, so I don’t want to overdo that.

Seeking Alpha

Seeking Alpha

So with 4 stocks making up about 40% of BBH’s total assets, and 10 stocks accounting for 2/3 of it, BBH is diversified enough for me. That’s because when I do own it (I do not currently), it will be perhaps a 10% portfolio position, and I don’t need to spread that across 200 stocks.

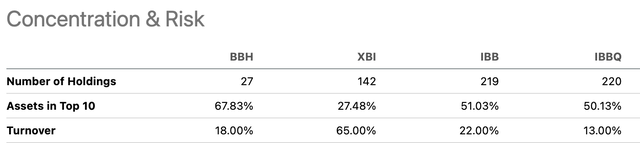

Also of note is the small number of holdings when compared to a few of its peers, which include holdings 5-8 times that amount. Another interesting figure is the 67% of assets in the top 10 holdings of BBH.

Now let’s look at a few of the critical members of BBH.

Amgen Inc. (AMGN) – A major player in biotechnology with innovative therapies to treat serious illnesses. Their broad portfolio includes advancements in oncology, immunology, and cardiovascular diseases.

Vertex Pharmaceuticals (VRTX) – A company specializing in the discovery, development, and commercialization of innovative medicines for serious diseases. They are leaders in cystic fibrosis treatments and expanding into other areas of genetic disorders.

Regeneron Pharmaceuticals (REGN) – Known for its innovative treatments in areas such as ophthalmology and immunology. They are recognized for their strong commitment to scientific research and innovation.

Gilead Sciences (GILD) – Known for its focus on developing therapies for infectious diseases, liver diseases, inflammatory diseases, and certain cancers. They are large in the development of antiviral drugs, particularly for HIV/AIDS and hepatitis C.

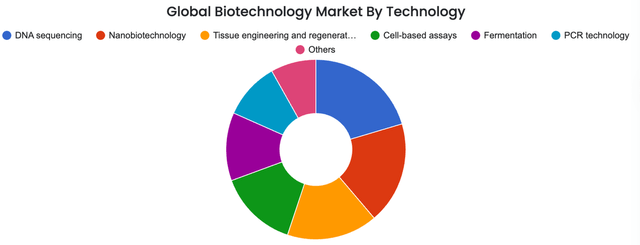

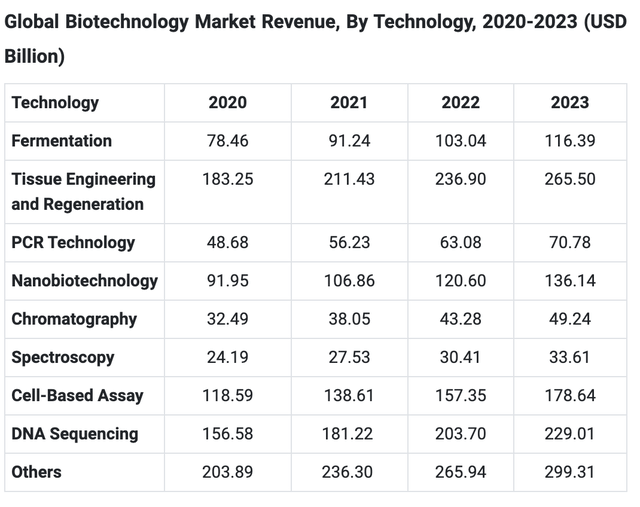

With the global biotech market projected to surpass $3.44 trillion by 2030, the sector is witnessing exponential growth, driven by the acceptance of emerging technologies and services that address significant global challenges. The wide variety of technology used is another promising aspect, as pictured below. There are several different avenues of tech equally leading this industry, showcasing all the different ways a positive impact can be made.

VanEck

VanEck

The dominant trend in the industry is through Artificial Intelligence development. The integration of intelligent algorithms enhances automation, aids drug development, helps identify medical risks and new drug targets, and identifies disease characteristics through image categorization. These technologies are integral in decoding vast genomic datasets and advancing precision medicine by tailoring treatments to individual genetic profiles.

AI aids tremendously in the drug discovery process by analyzing extensive datasets, accelerating the identification of potential drug candidates, and optimizing development timelines. Biomarker discovery benefits from these technologies, aiding in early disease detection and treatment response monitoring.

Gene editing: part of the biotech evolution

CRISPR leads the charge in this part of the biotech space. CRISPR, which stands for Clustered Regularly Interspaced Short Palindromic Repeats, originally a part of bacterial defense mechanisms, is now a precision tool for editing genes in various organisms, including humans. The power of CRISPR lies in its ability to modify DNA sequences with unprecedented accuracy, holding promise for correcting genetic abnormalities, treating hereditary diseases, and preventing certain conditions.

Treatment used to be similar for anyone who had the same disease. Age, weight, genetics, and lifestyle differences didn’t necessarily mean different treatment. Biotechnology is quickly improving personalized medicine to everyone’s unique genetic makeup, lifestyle, and environmental factors. Rapid advancements in DNA sequencing technology enable a faster and more cost-effective unraveling of genetic codes, making personalized medicine accessible and applicable across various medical fields.

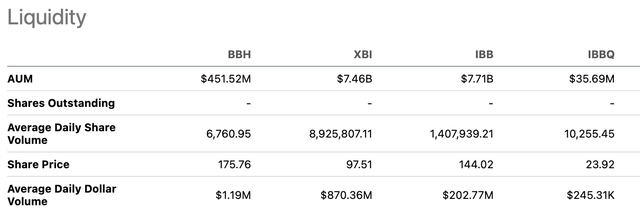

BBH under-discovered in comparison to some of its peers. With about $450 million in AUM, the average daily share and dollar volume are not even in the same category as SPDR S&P Biotech ETF (XBI) and iShares Biotechnology ETF (IBB).

Part of the AUM issue for BBH is similar to that of any ETF company not named iShares, Vanguard, or State Street. Those 3 dominate assets managed in the ETF space, which blinds investors to the many and diverse choices beyond the very largest ETFs.

Seeking Alpha

Conclusion: Trend change likely, in favor of biotech

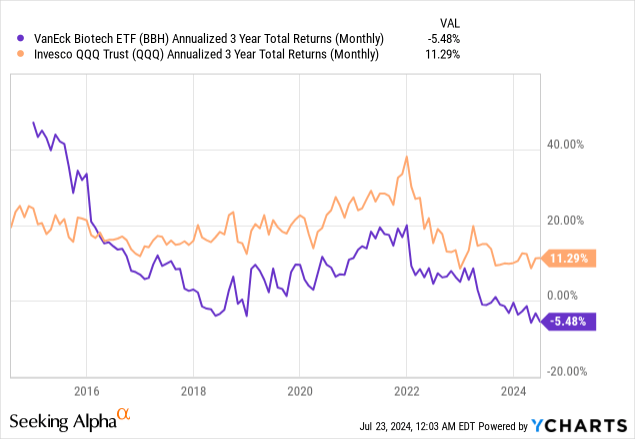

As the chart below shows, BBH, packed with market leaders in one part of the innovation business, biotech, has underperformed QQQ, which includes biotech but is dominated by other types of technology, particularly the FAANG stock giants. In fact, the latest 3-year reading (annualized) has QQQ up more than 11% while BBH is down 5.5% a year. There is always risk in this sector, but the once superior returns of biotech stocks compared to broader tech are not just overdue, it is showing up in the charts.

I like what I see technically here, and the top stocks in this sector are of high quality. I believe that as the market continues to focus on what to own while they reduce their traditional tech exposure, BBH will be one beneficiary. It gets a buy rating from me, with a 3-year time frame attached.